The Evolution of Real-Time Payments

Real-time payments are increasingly recognized as a critical component of modern financial systems, offering speed and convenience in an interconnected digital world. As we venture into the future, the recent launch of the Federal Reserve’s instant payment service, FedNow, stands at the forefront of a payment revolution in the US.

Instant payments by consumers are anticipated to reach 70% of all global transactions by 2027, a substantial increase from over 30% in 20231. This shall be driven by increasing merchant acceptance due to lower costs. China’s WeChat Pay and AliPay, India’s UPI, and US FedNow are expected to lead this instant payments transition.

The US has a fragmented payments landscape with multiple payment options operating independently. These include ACH networks, card networks, and transfer systems. It is also subject to a complex regulatory landscape – with multiple bodies having authority over different aspects of the payments system. Being a geographically expansive country, payment practices and preferences also differ across regions. While existing services like Zelle and The Clearing House’s Real Time Payments network offer instant payment functionalities, they differ in one crucial aspect: they lack the backing of a government-operated central-bank system, a characteristic seen in successful implementations in other countries. The complexity of the US market necessitates the implementation of a centralized, top-down real-time payments network, such as the one FedNow aims to provide.

By allowing users to send and receive payments instantly through their bank accounts, FedNow is expected to change the way businesses conduct transactions. With nearly one in three retailers planning to add real-time payments in the next 3 years, financial institutions are at a critical juncture. The race is on to take the first mover advantage. However, adapting to this massive change is no small feat, as it requires overcoming challenges and rethinking traditional processes. At this stage, a holistic future-proof strategy is needed. Businesses need to decide on the target customers, potential competition and build the roadmap for implementation, to stay ahead and competitive.

Exhibit 1. Real-time transactions in United States 2 (in USD Bn)

Decoding FedNow

What sets FedNow apart?

The FedNow service exhibits three key qualities: instant transaction settlement, round-the-clock availability, and immediate confirmation of payment for both the sender and recipient.

Fast payment solutions operate in two types of systems: “closed loop” or “open loop”. Closed-loop systems process transactions through a single provider. Both sender and receiver need to have an account with that provider to transact. Moreover, funds processed through such systems – like Venmo, Zelle, and PayPal are deposited in the wallet account and need to be moved to a bank account separately.

In “open loop” systems, transactions can occur between accounts at different banks – without the need for specific apps. Here, payments are made through a shared network – like FedNow or RTP Network, which routes and settles payments for the financial institutions enrolled in that network. While payment apps like Venmo and Paypal are changing the landscape of instant, person-to-person payments, FedNow enables settlement directly in the user’s bank account. The RTP network is similar to FedNow, but it is currently supported only by select banks in the US. FedNow caters to over 10,000 financial institutions – including smaller, community banks. Thus, FedNow provides a neutral and inclusive platform, with the objective of increasing accessibility and efficiency of payments for all.

Exhibit 2. Features with FedNow launch (3)

How Does FedNow Work?

FedNow is explained with the help of a real-life use case below:

- The receiver (i.e., Apex Properties) initiates payment by sending a payment message to its financial institution (FI)

- The Receiver FI or the service provider screens the payment and submits a message to the FedNow service

- FedNow service validates the message format and sends it across to the Sender FI

- The Sender FI sends an automated request for payment to the sender (i.e., Jack) as a push notification on his banking app

- The sender reviews the bill and gives confirmation to pay.

- The Sender FI sends a positive response to the FedNow Service

- FedNow Service debits and credits the designated master accounts of the Sender and Receiver FIs, settling the transaction

- Sender and Receiver FI instantaneously debit and credit respective accounts (of the sender and receiver)

- Confirmation of posting: FedNow offers this optional message functionality. Here, the Receiver FI informs the Sender FI that the funds are deposited in the receiver’s account.

Exhibit 3. Standard Payment Flow under FedNow (4)

A Comparative Lens

US Instant Payments Landscape

In the US real-time payments arena, two primary options emerge: non-banking payment apps like Venmo, Zelle, and PayPal, operating within closed-loop systems, and the Real-Time Payments (RTP) Network by The Clearing House (TCH), operating within an open loop system.

Funds in the non-banking apps are not secure as they lack deposit insurance. Moreover, users have no clarity on how the funds are held or invested. Alternatively, TCH’s Real Time Payments Network is a growing payment method, with expanding adoption among 250+ financial institutions.

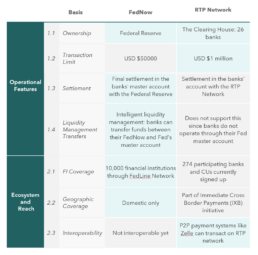

The FedNow service emerges as a game changer. It helps banks achieve final settlement in the books of the Federal Reserve. While both FedNow and RTP Network enjoy the advantages of open-loop systems, FedNow’s government backing, and broad FI reach contribute to its distinct advantages. When financial institutions face the decision of choosing between both, the final call depends on customer demand and individual requirements.

In conclusion, for FIs looking for interoperability, higher transaction limit, and cross-border coverage, TCH’s RTP is the right choice. At the same time, FedNow offers a broader coverage to most of the FIs (~banks, smaller Fis, and credit unions) in the US and direct settlement in the books of the Federal Reserve.

Exhibit 4. Key Differences between FedNow and RTP Network

Exhibit 5. Potential Adoption Groups (5)

FedNow Adoption: Key Opportunities

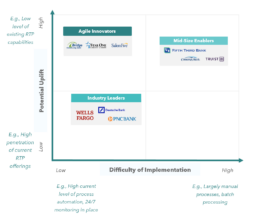

Agile Innovators:

They are expected to benefit the most from the FedNow launch due to the ease of implementation through technology solutions. Since they have low real-time payment capabilities, FedNow shall help them meet evolving customer demands, grow, innovate, and maintain competitiveness, resulting in high potential uplift.

Mid-Sized Players:

While some of them have RTP receive-only functionality enabled, most have chosen to wait for the FedNow launch. They can implement FedNow by using a modern payment hub. For example, a cloud-based payments-as-a-service solution that helps in easy integration and is cost-effective, and scalable for the future.

Industry Leaders:

Since they have a high level of existing real-time processing capabilities, they have the resources and capabilities to implement FedNow. They will enjoy a first-mover advantage and offer both FedNow and RTP Network. This shall help them gain a competitive edge, resulting in moderate potential uplift.

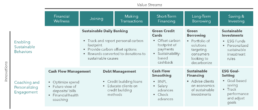

Exhibit 6. FedNow opportunities for Financial Institutions

Global Insights and Future Outlook

By studying the successful implementations of RTP in other countries, valuable insights can be gained regarding the potential benefits, challenges, and prospects of introducing FedNow in the United States.

According to a recent survey, approximately 90% of financial institutions and businesses are either implementing or planning to implement the FedNow system within the next two years. However, 57% of respondents identified the lack of ubiquity and interoperability as a significant hurdle for faster payment adoption (9).

There is uncertainty over whether FedNow shall be interoperable with RTP Network. While the communication language used by each system is the same, the setup for sending and receiving payments via either system is slightly different. Solving this challenge shall enable seamless real-time payments across platforms, networks, and banks.

RTP systems worldwide have successfully integrated with other financial services. Examples include the extensive use of QR codes for instant payments in India and real-time refunds by merchants in Australia. FedNow is currently more of a back-end system. It should focus on productizing its user experience to improve accessibility for all users.

As adoption grows, FedNow is expected to cause a shift in customer payment preferences from credit cards / digital wallets to banking apps with real-time payment operability. With faster access to funds, consumer spending is also set to rise. Overall, FedNow will set the US on the road to more digitized and efficient payments for all.

Exhibit 7. Key Learnings from Past Implementations

PIX: Brazil’s RTP Marvel

UPI: India’s Payment Revolution

Exhibit 8. Payment Tech Companies Driving FedNow Implementation

How is the Industry Preparing for FedNow?

With more than 110 pilot program participants, FedNow made significant progress before its launch in July. The industry is actively preparing to facilitate a seamless transition for banks. To support this effort, leading payment providers, processors, and networks have been working closely with the Fed throughout the pilot. As a result, companies like ACI Worldwide and Jack Henry and Associates have launched innovative solutions that help banks connect easily to FedNow and other real-time payment networks. More initiatives are expected to emerge in the future, showcasing the industry’s commitment to embracing the future of real-time payments.

Exhibit 8. Payment Tech Companies Driving FedNow Implementation

Road to Implementation

The future of payments is real-time. FedNow provides a viable pathway to that future. To avoid being at a competitive disadvantage later, it will be beneficial for FIs to implement real-time payments now.

Demand Side Perspective:

- Understanding Market Trends and Competitor Activity

Financial institutions should keep track of the latest market trends and closely monitor competitor activities with their outcomes. They should study and analyze the areas where RTP adoption has gained traction to gain valuable insights into the potential opportunities and whitespace areas within the FedNow ecosystem.

- Assessment of Customer Needs

Financial institutions should keep a close eye on customer retention rates and their spending activity. They should focus on identifying customer pain points and the factors that influence customer decisions.

- Planning the integration of product offering

Financial institutions need to decide the connectivity model: (a) directly through FedNow solutions or (b) through a third-party service provider. It should also deliberate on the technology requirements, the partnership model, and the management of revenue, costs, and risks.

Implementation Perspective:

- Start with Receive Only

Receive-only implementation offers a path to start with instant payments in a streamlined, cost-effective manner. As per most of the community banks who participated in the pilot, setting up receive-only functionality was much easier than expected. This allows for gradual adoption and familiarization with real-time processing capabilities.

- Understand Additional Capabilities

The next step is to assess the additional capabilities required to handle real-time processing effectively. This includes evaluating the necessary technology infrastructure and systems that can support 24x7x365 operations.

- Roadmap for Automating Back Office Processes

Lastly, banks and FIs need to develop a roadmap for automating back-office processes. This involves integrating real-time payment capabilities into existing workflows and systems.

Defining a robust value proposition is not enough – sufficient thought needs to be put into alignment with existing operations, investment needs, operational model, and fleshing out the full business case.

__________________________________________________________________________________________________________

- Juniper Research Study, 2023

- ACI Worldwide RTP Report, 2023

- Federal Reserve Website

- Federal Reserve Website

- Kepler Cannon Analysis

- PYMNTS Report, 2023

- Federal Reserve Survey

- FIS Global Payments Report, 2023

- Recent Survey by Glenbrook Partners

- FIS Global Payments Report 2023

- FIS Global Payments Report 2023