The Real Time Mandate

Once a cumbersome and time taking process, payments have been altered forever. The increased speed, transparency, and ease of transacting through apps like Venmo, Zelle, Google Pay etc. represents the reality of payments today – this reality has been powered by the fast-growing phenomenon of instant payments.

Real time payment (RTP) transactions are likely to exceed 300B by 2023, growing at 40% per year worldwide.1 However, the overall opportunity remains untapped. Visa Inc. estimates US$ 185T in payment flows across B2B, B2b, B2C, P2P and G2C.2 Despite the opportunity, uptake of real time payments is still in early stages, with most growth coming from the P2P players. As customers get used to instant P2P payments and start expecting a similar experience across all types of payments, the next wave of untapped money flow is likely to be captured. In addition, as local real time payment schemes upgrade their functionality, and new systems like the FedNow are launched, other use cases will become more favorable.

Financial Institutions need to quickly find their own space in this ecosystem. They must redefine their value proposition and rethink their business models around this phenomenon.

With increased competition, not providing this capability to your customers can be very costly. However, several challenges need to be overcome. For banks that have relied upon traditional payments systems, the transition to real-time comes ridden with strategic, operational, and technical challenges. Deciding the right connectivity model for real time payment rails, modernizing current technology infrastructure, managing security concerns, and training dedicated teams to handle real time operations etc. represent key hurdles. At this stage, a holistic future-proof strategy is needed. There is a need to think through and dissect elements such as the target customers, the offering ,and competition to define the correct value proposition. In addition, chalking out a holistic plan with clearly defined goals and objectives, investment needs, and a holistic business case, among others, will help remove ambiguity from the implementation process.

There is a sea of opportunity, if only one can identify the best way to tap into it!

Growing Ubiquity of Real Time Payments

Traditional payments involving complex processes and delays have no place in today’s fast paced environment. With everything being immediate, it is no surprise that real time payments have sky-rocketed in recent times and will continue to do so throughout the decade. RTP transactions are likely to exceed 300 billion by 2023, growing at ~40% per year worldwide. Multiple factors are responsible for this growth, including:

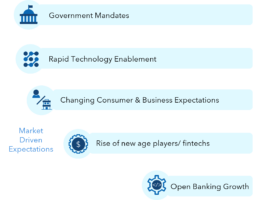

Government Mandates

Increasingly, governments and regulators are taking active part in the payment’s fabric of the country, including the development of RTP systems. For example, the launch of UPI in India, was driven by the central bank’s desire to reduce high levels of cash usage and bring more citizens and businesses within the ambit of the formal economy and taxation.

Currently, 55+ countries around the world have launched RTP schemes.3 Pushed by varying reasons, governments and other regulators have come to recognize the ability of instant payments to drive economic value.

In addition, by directly being a propagator of these payments, governments’ have been able to generate trust in these new payment methods and influence consumer behavior.

Exhibit 1: Drivers for Growth of Real Time Payments

Market Driven Expectations

Real time payments are fast becoming the go-to payment channel. Adoption is being driven by:

Rapid Technology Enablement. High proliferation of smartphones and digital apps, adoption of cloud-based solutions and growing ubiquity of new technology like 5G, Blockchain and IoT are all working towards creating a conducive environment for real time payments by offering support for higher speed, rich context, connectivity, and security.

Changing Consumer & Business Expectations. Consumers of today, especially millennials who make up the largest generation in the workforce, expect payments to be speedy, transparent, and convenient. In fact, 30% of individual consumers consider it a key factor when selecting a bank, and 24% are willing to switch banks if they lack this capability.4 On the other hand, even businesses are demanding a simple and fast experience to saving costs, streamline their operations, and protect themselves from hackers.

Rise of New Age Players/ Fintechs. In recent years there has been an influx of big tech players and fintechs constantly redefining the payments world. Not only has the supply of these players increased,

but consumer familiarity and demand for their solutions has gone up as well. In fact, almost ~64% of consumers around the world have used at least one fintech platform this year, compared to 33% in 2017.5 The innovative services and experiences offered by these players have spurred a new desire for instant and convenient payments systems to be established.

Growth of Open Banking. While maturity of open banking varies across markets, regulatory support for it has been universally rising. Markets are realizing the powerful combination of real time payments and open banking – open banking frameworks can support a more seamless integration and on-boarding process for financial institutions looking to piggyback new payment networks and offer those services to their own customers.

Unlocking the Next Wave of Growth

Visa estimates total money opportunity of US$185T across the globe, comprising of B2B, B2b, B2C, P2P and G2C flows. Despite the current high growth, it stands uncontested that there is a substantial money movement opportunity worldwide. Most markets are still in nascent stages of adoption and have only focused on P2P use cases until now as a substitute for cash and cheques in interaction between individuals.

To benefit from the next wave of growth, regulators, banks and FIs will need to support and serve a broader set of use cases beyond P2P. Even business payments are now ripe for innovation. For example, in the US, while B2B accounts for 76% of all money flow6, most of it is done via wire, check or ACH – systems that are slow, cumbersome to deal with and lack the ability to offer robust information and visibility into end-to-end payment transactions. Additionally, as the pandemic wreaked havoc in the supply chains across countries, many suppliers realized the need for real time payments tied to end-to-end tracking of goods.

Critical Need for Adoption

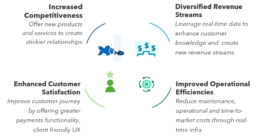

Creating new solutions based on real time payments can prove helpful in creating stickier client relationships. Moreover, banks can also take advantage of new functionalities such as ‘Request to Pay’, a messaging layer, and combine it with instant payments to enable payees to seamlessly pay them from their bank account.

Diversified Revenue Streams. Real-time processing generates immediate and accurate data that can provide deeper insights into the customers’ behavior, as well as help in finding new revenue streams. The real-time push is also adding greater weight to the concept of open banking and APIs, which will make data aggregation even easier. While data is invaluable, especially in B2B transactions, enabled in part by ISO 20022, it will ease the reconciliation process significantly.

Enhanced Customer Satisfaction. A bank’s ability to provide RTP is deemed the second-most important factor in choosing a banking partner (after it’s ability to provide solutions throughout the customer’s business lifecycle).7 Tech savvy small businesses, their customers, and suppliers need a faster and more robust way to pay bills, manage their cash flow, and protect themselves from hackers. Financial institutions of all sizes need to allow customers to pay the way they want to, including at the time they would like. With real time payments, banks can further digitize their customer experience to make it seamless and intuitive, ease onboarding and accept payments across various customer touchpoints.

Exhibit 2: Benefits of Real Time Payments for Financial Institutions

Improved Operational Efficiencies. Fast payments reduce costs for the maintenance and upgradation of legacy systems. Even operational costs are lower due to immediate decisioning of any exceptions encountered with transactions. The newer technology required for real-time also helps relieve banks from managing and synchronizing multiple databases, overseeing aspects of recovery and business continuity.

Several institutions are benefitting from a reduction in product time-to-market by ~90%8 because real-time processing allows immediate product configuration and migration.

Several institutions have already transitioned to Real Time Payments Rails with a variety of use cases. For example:

JP Morgan Chase has launched a ‘Request for pay’ solution with real-time payments that lets its corporate clients send payment requests to their retail customers through the bank’s app and website. The company has already begun a pilot with a corporate fintech to launch this service.

Commercial BankProv partnered with COCC as its core provider to connect to the RTP network operated by TCH (The Clearing House). The goal is to support high volume transactions, especially from its cryptocurrency clients, who need to move funds fast to mitigate valuation risk from the inherent volatility. In addition, the RTP network also allows the bank to enhance reconciliation, and immediately settle funds.

.

Roadblocks in the Path to Success

Banks are faced with multiple challenges on their journey to go real time. From connecting to the right rails to to developing the ‘true’ business case, there is a lot that needs to be figured out. Challenges include:

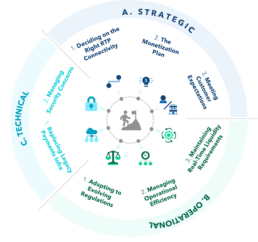

A. Strategic Challenges

- Deciding on the right Connectivity. Many banks have yet to decide how they’ll access the RTP system. They must decide between direct connectivity vs. connectivity through third-party service providers (TPSP). Banks need to choose the right partner from amongst hundreds of options (the choice of partner will impact the business case significantly), assess client demand, and determine the underlying technology strategy.

- The Monetization Plan. Currently there isn’t a dedicated model for banks to charge for real-time payments and it is hard to advocate for RTP without cannibalizing the existing credit card business. Additionally, as pricing will play a key role in the success of real time payments, banks need to decide whether to base it off ACH/ wire pricing or a combination of the two.

Exhibit 3: Challenges hindering real time adoption

- Meeting Customer Expectations. Often, specific customer groups, such as merchants and traders, are used to specific payment methods so might be reluctant to set up new processes. Banks will likely need to customize how they facilitate this transition. In addition, identifying the right use cases and user experience for existing customers poses another challenge. Users may have varying preferences and banks need to actively work towards identifying high value prospects and the right use cases and experience for them.

B. Operational Challenges

- Maintaining Real Time Liquidity Requirements. Faster payments pose a new challenge to banks’ liquidity management by making it more difficult to predict future liquidity positions. While in the case of traditional batch settlements, banks know in advance when transactions should settle, in case of real time settlements, it is driven by what the bank’s customers do. Banks can’t get pre-notified by a customer of payments going out or money being received.

- Managing Operational Efficiency in Real-Time. A key consideration is how a firms’ various functions must adjust to real-time. For example, due to the irrevocability of RTP transactions, funds are gone once the transaction is approved, without the ability to cancel or contest payments. To effectively disapprove of any potential fraudulent transactions, the right controls need to be put in place. Moreover, banks must also decide which operational area will support real-time payments for various clients, and how they will access the scarce expertise and skillsets needed to run these services.

- Adapting to evolving regulations. Regulatory action around information security, privacy, performance etc. is rapidly evolving as real-time payments are gaining traction. As a result, banks will need to be abreast of the latest regulations and identify ways to mitigate risks, dedicate the right personnel to manage areas such as consumer complaints, queries and avoid any issues that could lead to additional expenses to adjust the system.

C. Technical Challenges

- Replacing Legacy Payment Infrastructure. Traditional systems are typically not fast enough to handle each transaction end-to-end at an individual level, including processing, settlement and reconciliation. Additionally, they don’t offer 24×7 availability which is crucial to handle volumes at any point of the day. Banks must modernize their legacy systems by analyzing their existing technology, improvement costs and employee support to implement these services without disrupting current services.

- Managing Security. Due to reduction of payment time and payment touchpoints, they are increasingly becoming vulnerable to security threats. Banks are struggling to adapt their existing security infrastructure to short review times that are necessary for real-time processing. They need to identify and mitigate fraudulent transactions at lightning speed. This requires complex analytical capabilities and use of AI/ ML to assess transactions and offer predictive insights in real time.

Road to Implementation

There are a lot of components to real time – different networks, applications, and services – that customers want to enable and benefit from. The sheer task of being on top of so many components has made institutions unsure of where real time payments fit into their broader strategy. Thus, a holistic approach is needed, and several areas need to be dissected to define a bank’s real-time payments value proposition.

Exhibit 4: Roadmap to Implement Real Time Payments

Target Customers

Banks need to determine which use cases to prioritize. Knowledge of the growth potential and attractiveness of diverse use cases is important. Some key questions that bank need to answer include:

- Who are high value prospects for each real time payments solution? Are they existing or new customers of the bank?

- What use cases represent the maximum potential for growth and adoption by high value customer groups?

- Which customer touchpoints and outreach programs will be best suited to meet the needs of target prospects?

Competition

Lessons can be learnt from successes and failures of real time strategies deployed by direct and indirect counterparts. It is key to ‘skate to where the puck will be, not where it has been’. Key questions include:

- Who will the relevant competitors be, and which areas are they serving vs. the areas that represent whitespace opportunity?

- What lessons can be learnt from the deployment of real time payments solutions by industry counterparts?

- How do competitors successfully differentiate their solutions from others in the industry?

- Are there players from other industries and verticals that have or will foray into real time payments? How are they likely to impact our success? What is the best defense/offense?

Product/Value Offering

To support a diverse set of use cases, it is first important to connect to the most desirable rails. From government owned local RTP networks to real-time card rails offered by firms like Visa and Mastercard, there are multiple options to choose from. The choice of rails will play a monumental role in the features and functionalities that the bank will be able to offer to its end users. Upon deciding the rail of choice, the next step is to conduct a thorough due diligence and risk evaluation to assess the impact on onboarding, deposits, and revenue from connecting to the vendor. Lastly, to ensure a smooth transition to instant payments, the right technology systems need to be in place as the requirements of system performance, availability and scalability are critical for smooth operation. The technical architecture required to send and process payments in real-time is also quite different to the existing infrastructure.

Key questions include:

- Which real time rails and vendors will be best suited to serve planned use cases, meet customer expectations and offer major functionalities needed for the offering?

- What tech requirements will be necessary to support the real time payments solution? (24x7x365 operations, prefunding requirements)

- What will the partnership model look like with the vendor of choice? How will revenue, costs, and risks be divided?

Just defining a robust value proposition will not be enough – sufficient thought needs to be put into aligning with existing strategy, determining investment needs, defining the operational model, and fleshing out the full business case. This involves looking at the commercial market and analyzing potential gains from using real-time payments in comparison to traditional rails. Lastly, an execution playbook is also needed. Banks will be able to use this playbook to also test hypotheses against the real world including (1) Are expected volumes being generated (2) Are the right customers being served and onboarded? (3) How is RTP impacting the bottom line? Etc.

In Closing...

While real-time payments have already been in vogue for some time now, significant value remains untapped across use cases like business payments that go beyond traditional P2P. Banks/FIs need to hit the bull’s eye in identifying the best way to capitalize on this whitespace and do so better than competitors.

As banks begin implementing/ ramping up their real time transition, pertinent challenges need to be overcome – from the potential cannibalization of the existing card business, to performance and scalability issues faced with legacy infrastructure.

Developing a clearly defined holistic roadmap will be crucial in guiding success. To start, banks should rigorously assess target customers, the product offering, and competitor positioning to define their real-time payments value proposition. Alongside, a holistic business case needs to be developed to capture maximum benefits. Lastly, a clear understanding of the operating model and development of an execution playbook are imperative to win in this space.

References:

- ACI Worldwide ‘Keeping Pace with Innovation in Real Time Payments’

- Visa 2020 Investor Day Presentation

- Modern Treasury ‘Real Time Payments around the world’

- Pymnts.com

- Tipalti

- Bai.org

- Citizens Commercial Banking

- Adyen