Evolution of VARs

As technological needs are becoming increasingly complex and difficult to manage, it is impossible to deal directly with plethora of Original Equipment Manufacturers (OEMs). Today, most enterprises leverage Value Added Resellers (VARs) to handle the large inventory of IT assets, efficiently manage OEM contractual relationships, and negotiate better rates.

But the ‘value’ being demanded from VARs is undergoing a transformative change. The rapid evolution of the tech landscape has driven VARs to evolve from their historic role of reselling to becoming strategic technology partners to the business.

Drivers (1) of this shift include:

- Thinning margins on hardware sales has whittled away margins from reselling

- Increasing competition from direct sales by OEMs as they grow their presence in the more lucrative services business

- Move away from traditional bulk hardware purchases towards subscription-based pay-as-you-use models

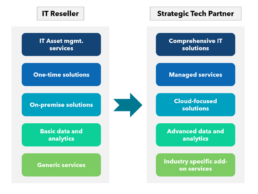

VARs have successfully responded to these industry changes by evolving from resellers into strategic technology partners (see exhibit 1 for further details)

Exhibit 1. VAR Capability Shifts

Beyond IT Asset Management

Traditionally, VARs performed the duty of managing the fleet of IT assets (hardware and software) including their entire lifecycle management from deployment to disposal. But, nowadays, lifecycle management is just the tip of an iceberg of technology solutions.

Move to Everything-as-a-Service

VARs are now providing end-to-end subscription based managed services (like Infrastructure as a Service (IaaS), Disaster Recovery as a Service, Virtual Display Infrastructure as a Service (VDaaS), etc.). This allows IT staffs to focus on strategic efforts, reducing the burden of everyday management tasks. This is quite a significant shift from point solutions that they traditionally offered.

Exhibit 2. Comprehensive IT Solutions

Beyond On-Premise Solutions

With the ubiquity of public cloud, moving from idea to realization has become dramatically quicker. Additionally, private cloud has its own benefits of enhanced security and autonomy, especially for sectors with stringent regulations, like financial services and government. Hence, enterprises today are seeking hybrid cloud environments, with public cloud for low value tasks and private cloud for high value secure tasks. In response to this, VARs are offering end-to-end cloud management solutions including programs on migration, modernization, optimization, and storage. These advanced cloud capabilities coupled with their deep expertise of on-premise hardware components has equipped VARs to easily manage all types of environments (public cloud, private cloud, hybrid, multi-cloud)

Beyond Basic Analytic Capabilities

Maturity of data analytics capabilities is now one of the key determinants of customer success. Even enterprises with existing analytical capabilities continue to invest heavily in advancing it. Consequently, VARs have developed expertise to design, build and deploy modern data platforms built for analytics and AI/ML solutions. Predictive models for customer insights, NLP for chatbots, Real-time data processing for personalized customer experience and smart device-based ecosystem are just few of the multitude of advanced analytic capabilities VARs offer towards enhancing customer experience.

Beyond Generic Services

Businesses today expect VARs to provide turnkey solutions, minimizing their effort as much as possible. The competitive market landscape has pushed VARs further, to offer highly personalized and industry specific add-on services. Given below is a snapshot of Financial Services specific add-on services.

Exhibit 3. Financial Services Add-Ons

Complexities of Managing VARs

With the surge in VAR offerings and multitude of players competing for business, one would expect firms to be able to negotiate competitive agreements with these players. However, realizing the full value of VAR relationship remains tricky.

Let us take a deeper look at some common challenges:

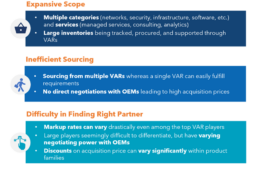

1. Expansive Scope

Businesses often get overwhelmed by the plethora of categories (IT hardware, software, infrastructure, network) and services (managed services, professional services, consulting, analytics) that can be sourced through VARs. In addition, sourcing decisions are often made in un-coordinated silos due to the wide array of requirements from across the organization.

Accurate tracking and reporting of inventory and spend is also difficult, especially with numerous instances of shared purchases between different parts of the enterprise. These can lead to accounting inconsistencies, duplicate buying, overbuying, or underbuying.

2. Inefficient Sourcing

Even with several VARs offering the full suite of products and services, firms may purchase through multiple VARs. This can lead to lower volume discounts, high cost of maintaining multiple contracts, and disparate solutions that are difficult to integrate. Additionally, engaging a VAR should never be the reason to not negotiate directly with your larger OEMs, where that is beneficial.

3. Difficulty in Finding Right Partner

The VAR market is quite competitive with several great options available. But even the largest players in the market, who appear similar on the surface, have varied negotiating power with individual OEMs. This leads to significant variation in effective markup rates and in price discounts that they extract from OEMs.

4. Opaque Pricing

When it comes to VAR pricing, markups are the most commercially contested component. In addition, other charges like SG&A, hidden under acquisition price so often go unnoticed, especially during negotiations. It is very difficult for firms to infer this information, as it is usually buried and bundled in the price quotes. Sometimes, pricing can get even more opaque, when VARs don’t disclose their negotiated discounts with OEMs.

Exhibit 4. VAR Sourcing Challenges

5. Unfavorable Pricing Models

The value VARs offer range from simpler services like maintenance to specialized design services. With the absence of tiered markup structure, firms are made to bear the expense of unutilized and rarely utilized services.

The variety of markup charging methods employed by VARs only add to the current complexity. For instance, VARs may mark up either as a percentage of acquisition price or as a commission on the discount they avail from OEMs. A closer look can also sometimes uncover sub-optimal blanket discounts across product categories. These multiple layers of pricing inefficiencies make negotiations difficult.

6. Poor Compliance

The countless number of SKUs, product categories, and service types purchased from VARs, sometimes lead to overlooking the specificity and thoroughness of contractual terms and conditions (T&Cs). This often results in weak terms on order fulfilment, replacement, payment, etc. Another common mistake is to not have clear definitions of the value-added services covered by the markup. Lastly, limitations in real-time tracking and reporting, can make it difficult to ensure compliance.

A well though out strategy is needed

Just going to the market is not sufficient. A detailed and well thought out sourcing strategy is needed. Exhibit 5 outlines the spectrum of opportunities for dramatically increasing the efficacy of your VAR relationship.

Exhibit 5. VAR Sourcing Levers

Inventory Right-Sizing

Right-sourcing the items purchased through VARs is the first step towards realizing value. Demand optimization efforts should include:

- Consolidation of local demand into centralized purchase for all applicable categories

- Weighing lease vs. buy options before inclusion into VAR purchase (especially for categories like Telecom).

- Rationalization of SLAs based on criticality

- Exclusion of non-critical items and inclusion of critical items based on service delivery risk

- Pricing Transparency

Firms should pay close attention to the effective markup being charged, especially since a small percentage change can have huge effect on the overall cost. It is critical to decouple all forms of hidden charges typically applied to bulk up the VARs margins. To start, every cost component should be broken down at a detailed level.

Firms should also seek to determine the VARs ‘true’ acquisition price for each OEM. Driving this transparency provides the rich information needed to negotiate an agreement that works for both, the VAR and you.

The Full Suite of Discounts

Effective negotiation of the full suite of discounts can have a substantial effect on bottom line. Exhibit 6 lists discounts that can be commonly negotiated :

Exhibit 6. Discount Levers

Tiered Markups

It is ideal for firms to negotiate for a tiered markup model based on the complexity of the services offered. Most often than not, businesses only require few of those high complexity services. An accurate understanding of the requirements and subscribing only to relevant services, makes sure firms don’t overbuy. Lastly, given the ever-evolving technical requirements, it is important to negotiate provisions to change tiers during the term of the contract.

Best-in-class T&Cs

Given the plethora of moving parts in a VAR negotiation, it is important to clearly align on the services and level of coverage included in the agreed upon markup. Rather than negotiating hard on all T&Cs, firms should strategically focus on categories that drive down their total cost of ownership e.g., order fulfilment, replacement, payment and have some leeway on the items less impactful for them. Robustness of the VAR’s tracking and reporting capabilities should be thoroughly evaluated before selecting a strategic technology partner.

In Closing...

Over the last few years, the role of VARs has shifted from reselling to becoming strategic technological partners. To take advantage of this evolution, firms should conduct a comprehensive review of the current VAR agreements and the full suite of OEMs that can be procured through these VARs.

This paper outlines a proven and comprehensive approach to maximizing the value from your VAR(s). We recommend conducting exhaustive forensics on the current agreements, vendors and requirements. Optimizing your demand and developing a strategic approach to sourcing VARs has consistently delivered big benefits for industry leaders.

__________________________________________________________________________________________________________

- From VAR To Solution Provider, Computer Economics, Avasant Research