With the evolving technological landscape, the insurance industry is finally undergoing a dramatic onslaught of changes.

Given the simpler nature of its products, the P&C industry has been rethinking its business model and devising innovative solutions — from digitalizing the customer experience, to appending a plethora of value-added services to their policies. With the growing comfort and convenience on the P&C front, consumers now expect a similar experience in its sister industry, Life & Health. Insurers must find ways to simplify processes across all products to deliver digitally enabled, smooth & responsive experiences.

Many insurtechs now deliver widely improved experiences and are finding ways to reach new customers. BIMA is transforming life insurance by offering pay-as-you-go mobile-based coverage, capturing a completely untapped, low-income market in developing nations. Similarly, Lemonade is setting new consumer expectations for insurers with 90-second underwriting & near-instant claims processing.

Today, insurers are providing an enriched set of services. Let’s follow Mary, a well-to-do US-based customer. From tailored product suites, to engaging but automated channels, to accessible advice and value-added services, insurance (as Mary knows it) is set to change.

1) THE RISE OF INSURTECHS

The product catalogue is being expanded and refined:

▪ Customization of Existing Products: Insurers are tailoring existing offerings with the help of real-time data from IoT sensors and alternate data sources. Fitness trackers, IoT enabled toothbrushes, cellphones, smart homes, GPS enabled cars, drones etc. are used to collect additional data on customers. These data points are then incorporated into the underwriting models.

These behavioral pricing models allow firms to minimize risk while lowering prices for well-behaved customers and gaining their loyalty. For instance, many insurers have partnered with Vitality which tracks an individual’s fitness and healthy behavior (like sleeping patterns) through an IoT enabled Fitbit device. Such tracking not only promotes healthy behavior but also incentivizes it by offering rewards as well as lower premiums.

This also enables customization – say Mary and her husband, John. John doesn’t indulge in physical activity, smokes and has an irregular sleeping pattern, while Mary is active (uses her fitness tracker) and gets at least 8 hours of sleep every night. In such a case, Mary might be offered a lower rate than John.

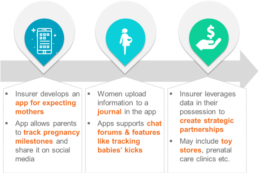

▪ Catering to ‘Interstitial Needs’: Insurers can now create products that cater to niche, previously unmet needs of customers & prospects. New data sources like hospital CRMs can be used to enable such products.

Addressing the needs of gig economy workers, like Uber drivers and Airbnb owners, insurers are using improved underwriting capabilities to offer products targeted especially at customers using their property for both commercial & personal purposes. Insurers are also increasingly offering cyber insurance, fulfilling a growing need in the digital world.

Another example is products targeted towards pregnant women (see Figure 1). While these needs were partially met through general health insurance plans earlier, insurers can now offer products targeting specific ailments by utilizing specialized data. After having a customized health cover tailored to her needs, Mary will also have products specific to her pregnancy needs. When Mary gets pregnant, she can then purchase specialized insurance linked to her prenatal care clinic.

If she gets diagnosed with a pregnancy-specific ailment like gestational diabetes, the CRM data from her clinic would be sent to her insurer, initiating an automatic claims payout without paperwork.

Figure 1: Insurance needs during pregnancy

2) AUGMENTED SALES PROCESS

Digitization is enabling the salesforce by strengthening both push and pull methods of customer outreach:

▪ Enabling Agents to Approach Customers: Mentoring solutions leveraging AI / ML can be used to provide personalized assessments for agents to enhance their skills and, hence, sales relationships. These assessments are customized to the insurer’s priorities and target segment, allowing agents to be more effective. This mentoring can also be taken a step further by incorporating augmented reality (AR), allowing agents to practice their sales pitches while on the move, with life-like subjects, using AR-based apps on their phones or tablets.

Further, AI backed virtual assistants are being used by insurers to simplify the sales process for agents, by automating the retrieval of client data and documents, and allowing agents to seek answers on basic queries seamlessly.

▪ Enabling Customers to Approach Insurers: Chatbots on social media platforms like Facebook messenger allow consumers to reach out and get informed about products. Building on the concept of self-help portals, these chatbots can answer customer queries and

redirect them to relevant product purchase options or agents. To further encourage customers to approach insurers, players are exploring the use of AR to provide customers access to a live agent, delivering an out-of-the-box experience and eliminating the need for in-person meetings. Now, Mary can simply open her Facebook messenger and get all details on her policies or policies at large without worrying about scheduling time with her agent.

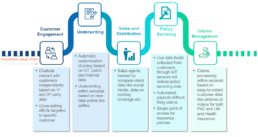

3) NEAR REAL-TIME PROVISIONING

The next chapter for life & health insurance will see a complete reimagining of product provisioning. Instead of the regular weeks- or months- long process of medical checkups and manual underwriting (still prevalent today, by & large), the journey, from receiving product recommendations to purchasing the product, is set to be shortened to just a few minutes for standardized policies.

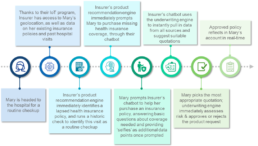

To facilitate instantaneous provisioning, insurers must start leveraging IoT data to make product recommendations in real-time. Furthermore, insurers need to incorporate alternate data sources to facilitate faster, higher confidence underwriting (perhaps selfies for health insurance, for instance). 3rd party sources need to be auto-sourced to ensure customers are only asked for incremental data-points, which will ensure the entirety of the data collection process is significantly faster. Figure 2 illustrates the customer’s experience in the future.

While insurers are yet to adopt AI / ML based automated underwriting on a large scale, insurtechs are ahead of the curve – insurers are either collaborating with them or are building them as a part of their incubation drives.

Figure 2: The Future Customer Journey

RiskGenius, for instance, uses AI / ML to analyze the language in insurance policies to create more efficient underwriting workflows. Others like UnderwriteMe, are exploring the use of predictive analytics to assess risks, significantly reducing the time taken for customers to get coverage. Mary will no longer have to spend days getting basic auto insurance- she will simply upload her license and car details online to get a customized coverage in few minutes.

For more complex products that need manual underwriting, AI-enabled bots can be used for underwriting assistance and agent advisory. Bots answer simple queries from underwriting agents, offering insights from risk analytics models to aid in decision-making. Bots can also assist in data retrieval and data collection, ensuring that the end-to-end underwriting process is faster.

4) RAPID, GAMIFIED SERVICING

Ongoing servicing and engagement of customers is also evolving in multiple ways:

▪ Faster Servicing: To speed up servicing, insurers are automating using AI/ML and bringing the process online – from claims filing to processing. For instance, Lemonade revolutionized claims, using their AI-based bot, Maya, to collect claims data through customer videos describing their reasons for filing the claim. A secondary bot speeds the analysis and processing of these claims, and payout is routed instantly upon approval – all in less than 3 minutes

Insurers are also leveraging drones and AR to get quick and accurate data for claims processing, especially within auto and home insurance. Drone and imaging technology advancements help insurers to obtain high-4

definition images that facilitate remote and accurate property estimations – reducing claims leakage and ensuring quick payout. If Mary’s house ever witnesses a calamity, she wouldn’t have to worry about arranging paperwork, running around for inspection and filling for claims on top of managing the damage as the drone would take care of the inspection and aid in a quick payout.

Apart from quicker claims, insurers can create chatbot-enabled portals, such as mobile apps, to give customers a one-stop-shop to manage account information or service basic needs. As a result, information about general insurance policies isn’t all that Mary can access through Facebook messenger- she can even get quotes on new policies and check the status of her claims, enhancing her ability to self-service.

▪ Gamified Engagement: Today, insurers are gamifying experiences by creating interactive apps on social media platforms or videogames. These apps reward consumers for educating themselves or adopting risk-averse behavior.

For instance, personalized products like Vitality, are often accompanied by a ‘gamified’ app that allows consumers to track their progress and unlock ‘levels’ of rewards through good habits.

Since Mary was aware that her healthy lifestyle would be rewarded when she bought her health coverage, she is even more motivated to brush off her lethargy and actively track her workouts with the insurer’s app to earn rewards. Such gamification ensures that Mary finds the app itself entertaining, perhaps by even offering games like ‘How will your old self look’ to get Mary hooked to it. This way the insurer also gets access to critical data on Mary, and others like her, for future cross/up-sell.

5) HOLISTIC ADVICE

An important differentiator for insurers today is provision of financial advice, so that they are viewed as financial partners by customers. Dissemination of advice is transforming in the following ways:

▪ Financial Wellness: Firms are also looking to tailor their advice to help customers assess their financial wellness holistically, instead of focusing solely on retirement or insurance. Insurers are interacting with clients through curated wellness assessment platforms offering an integrated and simplified user experience, with the goal of understanding consumers’ welfare and how it may be improved.

Mary & John, who want to plan their savings to make large purchases like real estate and cars, can now approach their insurer. Insurers will then give this information by assessing the couple’s current financial position juxtaposed against their financial goals, making curated product suggestions.

▪ Affinity-based Advice: Tailoring of advice is now being taken one step further by leveraging affinity-groups. Financial advice is customized to include unique requirements of niche groups, such as women-centric groups, income group etc. An insurer focusing on women centric group would hence offer Mary product suggestions or personalized investment portfolios, keeping in mind women-specific goals in general (and Mary’s) as well as factoring in women’s longer life spans & unique salary trajectories.

▪ Harmonized Channels: Insurers are expanding conduits through which they disseminate advice to emerging channels like social media, virtual assistants (via video conferences), in-app live chats, browser-based group forums etc. Insurers are also exploring robo-advisory service models, which can be fully automated, or hybrid with manual intervention after certain points.

Beyond this, insurers are trying to create a harmonized ‘omni-channel’ experience that captures conversations from one channel and 5

effectively relays it to all other channels- giving customers a “pick up where you left off” experience. For instance, if Mary starts a conversation with her insurer via Facebook messenger, she can continue it seamlessly with an in-person agent or in-app live chat without any ‘missing’ dialogue. Insurers can leverage the entire gamut of data they carry on existing clients and prospects to carry a ‘single’ advice conversation, ensuring customers like Mary feel confident in approaching insurers for financial advice.

6) ECOSYSTEM OF VALUE-ADDED SERVICES

Insurers now also need to start covering peripheral needs around insurance products. Essentially, creating an ‘ecosystem’ of value-added services.

This is a natural progression, as customers become accustomed to ‘one-stop-shops’ in other spheres of their lives, such as banking and e-commerce. Customers now don’t just want to buy an insurance product in isolation- they want access to services related to these products as well.

Insurers can go one step further and foster associations with the providers of value-added services outside of their immediate network and get them all on board to enable a truly comprehensive ecosystem. For instance, insurers serving small business owners have tied up with security companies to offer discounted private security devices to their customers. This enables small business owners to purchase security devices which would have otherwise been too expensive for their business. Now, Mary expects that her health insurance provider will help her gain access to medical services, acting as a bridge between her and ‘other service provider’. As a result, Mary will be able to contact her insurer through a call, website or app, to receive medical consultation, help in setting up medical appointments, and so on. The possibilities are limitless- it depends on the insurer how creatively they leverage new & old partnerships to provide value-added services to customers.

The insurance ecosystem should bring together a comprehensive suite of add-on services. When Mary and John purchase a home insurance policy, they can install IoT-enabled devices to turn their homes into ‘smart homes’ (see Figure 3).

These IoT sensors cover many services like remote control on thermostats, automated lights and door locks, online access of security footage through the insurer’s app etc. As soon as any leakages, faulty appliances or break-ins are detected, the insurer and customers would be alerted. Relevant professionals would be automatically notified too.

Figure 3: IoT Based Smart Homes

This also eliminates the need to file for claims- as insurers can use this data for automatic payouts to IoT-enabled customers like Mary & John.

With the end-to-end ecosystem, customer touchpoint with insurers will increase. Customers will rely more heavily on their insurer for day-to-day occurrences. This increased reliance would also enable insurers to retain their customers, gain additional insights into customer behavior and, eventually evolve to become a true financial partner.

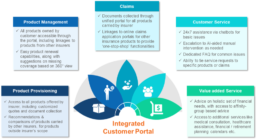

7) CUSTOMER-CENTRIC PORTALS

The portal should provide single-point access to purchase all insurance products and the services around them, irrespective of what is carried by the insurer. The idea is to eliminate the need for customers to branch out to any other apps or portals to meet their holistic needs.

The portal could enable the customer’s journey through the following features:

- Provisioning of all insurance products (even those not offered by the insurer)

- Management of all products owned by the customer (link to other servicing portals)

- Digital claims filing & management using new data sources such as photos & videos

- 24×7 automated & manual customer service

- One-touch access to value-added services

Figure 4: Provisions of the Integrated Portal

Let’s consider what this would look like for providers that only carry a subset of insurance products, such as Mary’s insurer XYZ that only carried life & health products. When Mary decides to buy auto insurance, she logs into her insurer XYZ’s portal. Insurer XYZ, not carrying an auto insurance product of their own, provides Mary flexibility of purchasing from other insurers by creating a marketplace-type menu for Mary to choose from. XYZ’s portal redirects Mary to the auto-insurance providers’ purchase page and provides Mary the option to manage all her policies at one place, irrespective of the carrier.

After purchase, Mary wants to set up a car servicing appointment using her new auto insurance policy. Despite being a life & health insurance provider, XYZ’s ecosystem of value-added services is holistic. As a result, Mary can book an appointment using XYZ’s integrated portal, which automatically pulls out details of her auto insurance policy from its policy management functionality. Naturally, for customers like Mary, XYZ’s portal becomes their one-stop-shop for all related needs.

Once the insurer creates such a unified portal, they would have the ability to pull in and engage customers throughout their lifecycle, across all types of insurance products. An all-inclusive, product-agnostic, dynamic and easy-to-use portal is set to be a critical differentiator in the years to come to transition insurers from financial services providers to ‘financial partners’.

8) CUSTOMER & OPERATIONAL DATA COLLECTION

Since data is the new gold, tapping into its potential is critical for success:

▪ Data from all parts of the customer journey needs to be collected within an integrated

data management system- the 360° customer view (see figure 5). This data should then be used to improve processes in different parts of the customer life cycle, cutting across functional and product silos- from insights in marketing & sales, to claims payout and servicing. Once Mary’s insurer gets data on her financial plans through retirement advice offerings, it can help them understand Mary’s upcoming needs. An impending house purchase, for example, may be used to preempt her home insurance requirements for sales outreach.

Figure 5: Integration of Data Across the Value Chain

Leveraging a new suite of data:

– 1st party data: Real-time data collected via IoT sensors as well as alternate data sources like selfies, videos, live posts & locations, etc.

– 3rd party data: Data available on other platforms like social media, chats, messages, or through data provider partnerships like hospital CRMs, car servicing centers etc.

This new suite of data has become much more powerful with the advent of AI / ML because of possibility to extract coherent conclusions out of otherwise ambiguous sources.

For instance, facial analytics is now in the realm of possibilities. New algorithms can be used to study selfies, and scientifically & accurately (well, more accurately than before) extract information such as age, smoking habits etc. out of a simple picture. For simple health policies or renewals, this could be a breakthrough development.

Insurers can also generate revenue through these new streams of data. Insurers can use data from IoT sensors, selfies or specialized devices & apps to create partnerships with providers who can benefit from the data, like cab agencies, fitness clubs etc. Customers benefit from special deals and discounts, providers benefit from enriched data. Figure 6 exhibits this.

Figure 6: Using Data to Generate Alternate Revenue

9) DIGITAL WORKFLOWS

Although data and talent are prerequisites for delivering next-gen experiences, they are futile unless all foundational processes are streamlined, integrated and digitized. If the end-to-end value chain, from marketing & sales to policy servicing, isn’t digitized, then the future we’ve envisioned- a future that delivers policy decisions in minutes- won’t be achievable. Manual intervention will continue to be needed for years & years to come, but certain core operations need to be automated to ensure customers do not receive a tedious experience even for simple insurance products- unacceptable in today’s landscape.

Even in the absence of automation using AI/ML, workflow digitization should look akin to the following:

▪ Sales and Marketing: State-of-the-art CRM platform automating distribution of customer queries to relevant salespersons, and driving targeted sales using social media, comprehensive customer data & advanced analytics-based segmentation

▪ Policy Administration and Underwriting: Digital application filing & processing, algorithmic underwriting model (dynamic and adaptable to change) to automate simpler products

▪ Customer Engagement: Integrated multivariate consumer platforms feeding into to a state-of-the-art CRM tool, customer service equipped with the 360° customer view and facilitating an omni-channel experience

▪ Documentation: Online document collection, centralized document management, automated data retrieval

▪ Billing and Claims Management: Centralized billing process using automatic invoice generation, online claims repository with automated payout upon approval

Apart from digitizing the end-to-end processes, an integrated insurance solution be used for:

▪ Insights and Intelligence: Analytics using data collected during the process, made available to all relevant functions

▪ Regulatory and Compliance: Automated compliance engines pre-built into business rules consistently, ensuring regulatory run-ins and manual intervention from compliance personnel are minimized

Figure 7: Insurer-Fintech Associations

10) DRIVING INNOVATION THROUGH FINTECHS

Insurers need to foster new ideas and a forward-looking skillset. Fintechs bring together technology and such creativity, resulting in solutions that help increase efficiency and offer better customer experiences. Working along with fintechs is a proven way to accelerate innovation.