(Not) Selling Life Insurance in Asia

Background

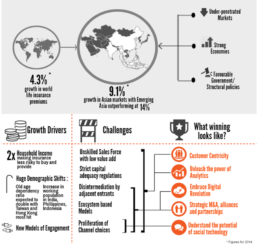

In 2014, the life insurance market rebounded after a protracted period of weakness; premiums worldwide grew 4.3%, after a decline of 1.3% in 2013, exceeding even pre-crisis growth rates. This was accompanied by a significant flux in competitive dynamics, as US and European markets were overshadowed by their Asian counterparts. Driven by China, India, Indonesia, Malaysia, the Philippines, Thailand and Vietnam, Asian markets in aggregate grew 14% after what had been a historic lull. Buoyed by structural catalysts like under-penetrated markets, strong economies, and favorable government policies, Asian insurers have enjoyed a period of remarkable prosperity.

Amidst this boom in business however, Asian consumers remain largely underinsured. In comparison with their Western counterparts, which typically invest 7-8% of GDP on life insurance, Asians (with the notable exception of Japan) spend just 3% on average. This, coupled with the lack of emphasis on public health and safety by many Asian governments, creates significant headroom for growth. To address the shortfall in public care, insurers have been tasked with administering plans to growing end markets, often through policy changes like the opening up of insurance markets in India, promotion of protection products, and institutionalizing goals to increase insurance penetration to 5% by 2020 in China. Strong macro-economic indicators like healthy capital markets, as well as the devaluation of the yen in Japan, have also triggered a rising demand for investment products, spurring growth.

"Buoyed by structural catalysts like under-penetrated markets, strong economies, and favorable government policies, Asian insurers have enjoyed a period of remarkable prosperity."

Two Sides of the Issue

GROWTH DRIVERS

As secular growth in the market continues to change the insurance landscape, Asia has a number of GROWTH DRIVERS working in its favor:

- Rise in Household Income and Wealth: Average levels of wealth in Asian countries are expected to rise rapidly until 2024, with India leading the pack at a brisk 6.9% CAGR. Household wealth is also expected to double over the coming decade, from $81 trillion today to $175 trillion by 2025. This will dramatically increase the size of end markets for life insurance.

- Demographic Shifts: In a number of major Asian economies, the working age population is expected to shrink – in the next 15 yrs it is expected to drop by 12.1% in Taiwan, 10.4% in both Japan and Hong Kong, 9.2% in South Korea, and 7.2% in Thailand. Mortality is not rising however; as a percentage of the population, the number of elderly citizens is expected to increase sharply. Hong Kong and Taiwan will be worst hit as the elderly grow to comprise 43% and 37% of the population, up from 20% and 17% respectively1. Given that pension systems in many Asian countries are still in nascent stages, insurers will most likely have to fill the gap. On the other hand, a huge chunk of the population in India, Indonesia and the Philippines is expected to enter the labor market, boosting the household incomes and thus consumption levels.

- A New Model of Engagement: As Asian markets become more technologically savvy, digital capabilities are empowering customers to engage in multiple ways with their current/future insurers. After the crisis, consumer engagement with insurers spiked as consumers became more heavily involved in the purchase process. Smartphone and social media penetration is very high, enabling individuals to compare products and prices online, collaborating within their social network to resolve queries and often broadcasting good and bad experiences with their insurers.

CHALLENGES

However, there are significant CHALLENGES as well:

- An Untrained and Inconsistent Salesforce: Though the transition to third party channels or bank partnerships is underway, the in-person agent consultation legacy is here to stay in the near future. One of the major reasons for such a practice is the complexity of the product and rider literature. In addition, as consumer savviness increases, the product push model adopted by the mass-marketer insurers will be significantly threatened as the advisory model gains popularity and acceptance.

- A Vast, Confusing and Imbalanced Product Mix: Most insurers have a wide and often confusing array of products, but 90%+ of profitability is concentrated in a handful of services. Firms are hesitant to address this complexity, fearing to appear uncompetitive, and so continue to maintain a highly imbalanced portfolio, vexing would be customers!

- Strict Capital Adequacy Regulations: In the wake of the financial crisis, capital allocation regulators have grown sharp teeth, making investment returns harder to achieve. Hong Kong is seeing a shift from the rule-based Solvency I framework to a Risk Based Capital (RBC) framework. RBC, which dictates the minimum capital that an organization needs to hold, is expected to be implemented this year. Concerns are that this might lead to rapid market consolidation, cessation of business among small and midsized insurers, and the exit or withdrawal of international players due to cumbersome capital requirements not present at home. This effect has already been felt in Japan and Taiwan, where substantial outflows of foreign capital have been driven by multinationals feeling the effects of lower margins and operational challenges. This is turn puts sector-wide ROI under pressure, decreasing attractiveness to investors

- Disintermediation by Strong and Trusted Network Players: Adjacent businesses are entering insurance using their core strengths, like strong networks, huge information repositories, and deep distribution channels. Such entrants might be successful in squeezing out insurers and eating their share and scale. Such was the case of Rakuten, Japan’s largest internet company which bought a life insurer, AIRIO, and rebranded it as Rakuten Insurance, exploiting its cross-selling capabilities and high degree of penetration amongst Japanese consumers.

- Ecosystem Based Models: Insurers in Asia have tended to advance their value chain to create their own insurance ecosystem through a network of companies, institutions and consumers. Discovery and AIA have joined forces for a strategic venture, offering a wellness based life insurance model in Asia that gives users discounts and rewards for improving their lifestyles, and also provides the knowledge, tools, and personalized wellness programs necessary to achieve results. Such a model helps cut claim costs due to improved consumer health, and projects an image of the firm as a health manager rather than an insurance company, boosting popularity amongst customers.

- Proliferation of Channel Choices: The increased reach of the internet, especially in the mature markets of Asia, is spurring new distribution relationships and enabling product innovation and service improvement. The industry shift from an independent agency model to a captive agency model, the use of corporate brokers, integrated bancassurance models, and online selling are all enabling such opportunities. Take for example AIA, which is setting up an integrated bancassurance model with Citi bank in 12 Asian regions, or PingAnn’s leverage of We Chat. Players that aren’t thinking of an omni-channel delivery model risk falling by the wayside.

Winners

Although traditional players are still well entrenched, the WINNERS of the next decade will not necessarily be the ones that have history on their side, but those that do the following “inflectional” things well:

- Customer Centricity: Premium growth and long-term sustainability can only be achieved by keeping customers central to the business. Customers will realize value add only if their satisfaction is the guiding principle of the initiatives that insurers undertake. This transition from ‘selling’ (read as pushing) to ‘not’, would require significant investments and initiatives across the value chain of the insurance industry. This would also require significant back end changes starting with an overhaul of the incentive structure, stringent recruiting, skill-based training and development of performance tracking.

- Fully Unleash the Power of Analytics: Big data, predictive modelling and other analytics approaches hold significant opportunities to transform the traditional sales process by enabling insurers to evaluate their current strategies. They can also leverage analytics to predict the success of upcoming initiatives and optimize their operations by improving pricing, reducing claims costs, and detecting fraud by digging into the spending patterns of prospective customers and assessing their risk profiles.

- Embrace the Digital Revolution: From online distribution channels to backend processing optimization, from the internet of things to connected devices, digitization has opened up numerous paths towards innovation for insurers. Allianz is a good example of a traditional insurer investing €400-500 million per year in initiatives to enable transaction capability (online research, purchasing, and servicing) along with process digitization, standardization of customer interfaces, and a 360-degree customer view. We think the next winner in Asia needs to have digital as a significant part of its ecosystem.

- Identify M&A / partnerships and Alliance Opportunities: Strategic goals can be accomplished via acquisitions, mergers, and partnerships such that they offer synergies like lighter capital requirements, increased customer reach, new market entries, and the launch of insurance ecosystems.

- Use Social Technology: Consumers are keen to leverage social media as a platform to share and research reviews of insurers, particularly in Asia. This point was made clear in a recent survey conducted by a leading bank, in which 26% of Asian customers said they rely on the recommendation of their friends and families in choosing an insurer. Some insurers like Manulife China have leveraged this platform as a distribution channel; they began selling insurance through We Chat, one of China’s most popular messaging apps, and ended up selling 27,000 policies in the first two weeks!2 Thus, social technology not only serves as a brilliant platform for generating leads, but also consumer insights and marketing intelligence. The ability to gather such data is also extremely valuable in product development, where running and tracking campaigns and generating brand loyalty is essential to surviving fierce competition.